Click here to read the previous silver trends article.

Fueled by 2020’s demand surge, 2021 saw silver hold above US$20 per ounce for the first time since 2014.

But while investment positivity kept the white metal from sinking below US$21, broader market uncertainty and concern over industrial demand kept silver rangebound below US$28 for the year.

The value of silver held up for the first six months of 2021, with the white metal rallying to a 10 month high of US$27.92 on June 21. In the months since then, the silver price has consolidated, trending lower month after month until reaching a year-to-date low of US$21.52 at the end of September.

Values edged higher throughout October and November, taking gold‘s sister metal to US$22.82 to end November.

Silver trends 2021: Investment demand a prime Q1 driver

2021 began with silver holding in the US$26 range, before trading activity spurred by an online social media outlet pushed the metal to an eight year high in mid-February.

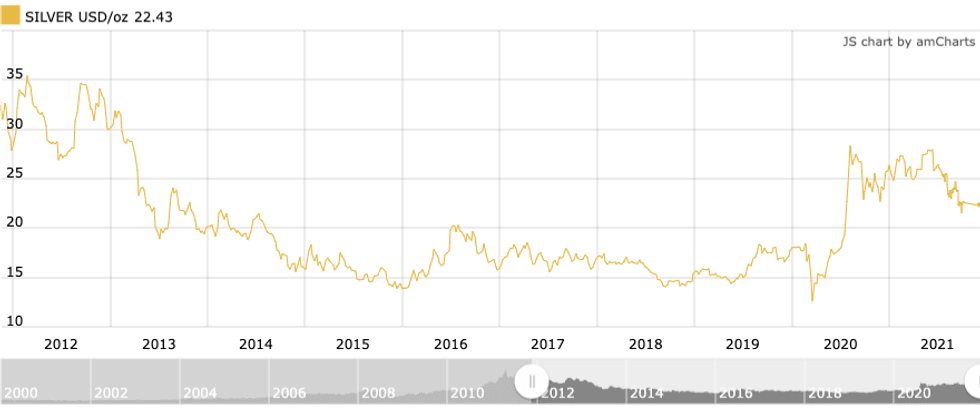

Silver’s 10 year price performance.

Chart via Kitco.

As web-savvy investors targeted GameStop (NYSE:GME) short sellers, members of the Reddit forum WallStreetBets set their sights on silver. WallStreetBets members have since distanced themselves from the metal, but the “silver squeeze” quickly spread across platforms like Twitter (NYSE:TWTR), pulling in more participants.

The silver price soared to an eight year high of US$28.55 on February 1 before slipping to US$26.10 four days later.

“It’s really showing us that the power of social media is immense,” Gareth Soloway, chief market strategist at InTheMoneyStocks.com, told the Investing News Network (INN) at the time.

“When you have 3 or 4 million people, even if they’re just putting US$1,000 or US$2,000 in a stock, it can make it a meteoric rise in these stocks.”

As a result, silver exchange-traded product (ETP) demand soared to an all-time high during the first quarter, when holdings topped 1.2 billion ounces, marking a six year high in segment demand.

By the end of the three month period, silver had settled into the US$24.90 range.

Silver trends 2021: Duality aids in demand growth

While the Reddit-induced excitement may have waned early in the year, growth in silver investment demand continued to be a trend over the ensuing months.

Silver’s relation to gold and ties to the base metals sector helped it rally to a year-to-date high in Q2.

“After touching a four-month low of US$23.78 at the end of March, silver began to recover, reaching a three-month high of US$28.90 by mid-May, as support emerged from a weaker dollar and from the slide in yields over much of this period,” the annual “Precious Metals Investment Focus” report from Metals Focus reads.

The global economic recovery aided the white metal’s price growth during the quarter as well, with industrial demand continuing to recover following 2020’s disruptions.

“Silver was also boosted by the ongoing robust rally in base metal prices as the global economy came back to life. As sentiment turned positive for silver, COMEX positioning and ETP holdings also improved with the net managed money long jumping by 75 percent in April,” the precious metals report states.

By mid-June, silver had reached US$27.92, up 12 percent from the beginning of April. The mid-year uptick was largely facilitated by the US Federal Reserve’s hawkish tone as it stated that interest rates would likely rise twice before 2023. A week later, values fell below US$26.50 and continued to decline.

At the end of the Q2, the silver price was able to register its only quarterly gain for the year, adding 2.17 percent from April’s US$24.92 level to reach US$25.46.

Silver trends 2021: Rising demand leads to supply deficit

Following a summer of uncertainty and silver market doldrums, the white metal sank to a year-to-date low of US$21.52 at the end of September, a 15.93 percent decline from January. However, the September consolidation served as a launching point for the metal’s Q4 performance, with prices trending higher throughout October.

Widespread inflation, rising demand and the Fed’s announcement that pandemic aid would be ending were all tailwinds for the silver price. By mid-November, the silver ETP space had added 87 million ounces for the year, growing total holdings to 1.15 billion ounces.

Despite global supply disruptions and a chip shortage, industrial demand also increased. The green energy sector, where silver is used in photovoltaics and other segments, contributed significantly to demand. Metals Focus anticipates that industrial demand will have climbed 8 percent by the year’s end to hit 524 million ounces.

Physical demand is also on course to register a six year high, with bar and coin purchases climbing 32 percent year-over-year to 263 million ounces (Moz). Much of that increase has come from more buying in the US and India.

“Building on solid gains last year, US coin and bar demand is expected to surpass 100 Moz for the first time since 2015,” the Silver Institute’s November “Interim Silver Market Review” states. “Growth began with the social media buying frenzy before spreading to more traditional silver investors.”

The report adds, “Indian demand reflects improved sentiment towards the silver price and a recovering economy. Overall, physical investment in India is forecast to surge almost three-fold this year, having collapsed in 2020.”

The upward trend across all demand segments throughout 2021 has prompted Metals Focus and the Silver Institute to forecast that total demand will reach 1.29 billion ounces for the first time since 2015.

On the flip side, the supply segment has steadily contracted since February, even though mined silver production rose 6 percent year-on-year to 829 Moz.

“This recovery is largely the result of most mines being able to operate at full production rates throughout the year following enforced stoppages in 2020 due to the pandemic,” reads the Silver Institute’s review.

The largest increases in output in terms of country will come out of Peru, Mexico and Bolivia, where 2020 production was heavily hampered due to the pandemic.

“Meanwhile, strong silver and by-product metal prices this year have improved profitability in the silver mining sector despite rising input costs,” the report notes.

“Average margins in the industry are currently at their highest since 2012 and only 5 percent of global primary silver mines were operating with costs above the silver price in the first half of the year.”

Significantly increased demand paired with modest growth in production will result in a 7 Moz physical deficit in 2021, the first deficit in six years.

Silver is the only precious metal projected to be in deficit this year. However, even with its tightening market and positive demand fundamentals, the white metal has underperformed compared to gold and base metals.

Silver trends 2021: Metal undervalued as year ends

Although silver outperformed gold in 2020, the gold-to-silver ratio has remained above 73 since August and moved as high as 80.19 at the end of September.

During a precious metals presentation in early December, Neil Meader, the London-based director of gold and silver for Metals Focus, explained why silver prices have lagged gold.

“I think in many ways, it’s because it’s lacking the defensive underpinning that gold has. It’s quite common to see gold as a safe haven, and silver’s slightly more speculative,” he said. “So we might need a rally where silver’s higher beta really kicks in to see a substantial shift in that gold-to-silver ratio.”

The silver price rose to a 45 day high at the end of November, touching US$22.87. In the weeks since, the metal has faced headwinds from the spreading Omicron variant, which has weighed on the commodities space.

Even so, the end-of-year slump is likely to be short-lived, as bargain hunting could lead to an increase in demand for the already stretched market.

Watch Marcus discuss how market manipulation prevented silver’s 2021 growth.

Aside from those factors, some industry participants have pointed to market manipulation as the reason silver hasn’t managed to break higher in 2021.

Chris Marcus, founder of Arcadia Economics, has vehemently spoken out against this issue, which he believes is keeping the white metal suppressed. Nevertheless, he sees an end in sight and said he would be “stunned” to see the white metal still lingering in the US$25 range at the end of 2022.

“If you see silver above US$30 for a couple of days — say you see silver above US$30 on a Thursday and it goes up to US$31 or US$32 on Friday, and on Monday it’s still in the US$30s. I would imagine at that point it may as well be US$50,” he told INN in a conversation toward the end of 2021.

“Once (silver) goes through that break point, you’ll know it when you see it, and I don’t think it’s going to take that much longer for that to occur.”

Don’t forget to follow us @INN_Resource for real-time updates!

Securities Disclosure: I, Georgia Williams, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.

From Your Site Articles

Related Articles Around the Web

window.REBELMOUSE_LOWEST_TASKS_QUEUE.push(function(){

if (!REBELMOUSE_BOOTSTRAP_DATA.isUserLoggedIn) {

const searchButton = document.querySelector(".js-search-submit"); if (searchButton) { searchButton.addEventListener("click", function(e) { var input = e.currentTarget.closest(".search-widget").querySelector("input"); var query = input && input.value; var isEmpty = !query;

if(isEmpty) { e.preventDefault(); input.style.display = "inline-block"; input.focus(); } }); }

}

});

window.REBELMOUSE_LOWEST_TASKS_QUEUE.push(function(){

var scrollableElement = document.body; //document.getElementById('scrollableElement');

scrollableElement.addEventListener('wheel', checkScrollDirection);

function checkScrollDirection(event) { if (checkScrollDirectionIsUp(event)) { //console.log('UP'); document.body.classList.remove('scroll__down'); } else { //console.log('Down'); document.body.classList.add('scroll__down'); } }

function checkScrollDirectionIsUp(event) { if (event.wheelDelta) { return event.wheelDelta > 0; } return event.deltaY < 0; } }); window.REBELMOUSE_LOWEST_TASKS_QUEUE.push(function(){ !function(f,b,e,v,n,t,s){if(f.fbq)return;n=f.fbq=function(){n.callMethod? n.callMethod.apply(n,arguments):n.queue.push(arguments)}; if(!f._fbq)f._fbq=n;n.push=n;n.loaded=!0;n.version='2.0'; n.queue=[];t=b.createElement(e);t.async=!0; t.src=v;s=b.getElementsByTagName(e)[0]; s.parentNode.insertBefore(t,s)}(window,document,'script','https://connect.facebook.net/en_US/fbevents.js'); fbq('init', '2388824518086528'); }); window.REBELMOUSE_LOWEST_TASKS_QUEUE.push(function(){ document.addEventListener("mouseleave", function(event) { const localKey = "ModalShown"; if ( window.__INNGlobalVars.isFreeReport || window.__INNGlobalVars.activeSection === "my-inn" || window.localStorage.getItem(localKey) ) { return false } if ( event.clientY <= 0 || event.clientX <= 0 || (event.clientX >= window.innerWidth || event.clientY >= window.innerHeight) ) { console.log("I'm out"); let adWrp = document.querySelector("#floater-ad-unit"); let adWrpClose = document.querySelector("#floater-ad-unit--close"); if (adWrp && adWrpClose) { adWrp.classList.toggle("hidden"); googletag.cmd.push(function() { googletag.display('inn_floater'); }); adWrpClose.addEventListener("click", function(e) { e.preventDefault(); adWrp.classList.toggle("hidden"); return false; }, false);

window.localStorage.setItem(localKey, 1); } } });

});

Source link

source https://d0llars.com/silver-trends-2021-demand-grows-as-supply-shrinks/

No comments:

Post a Comment