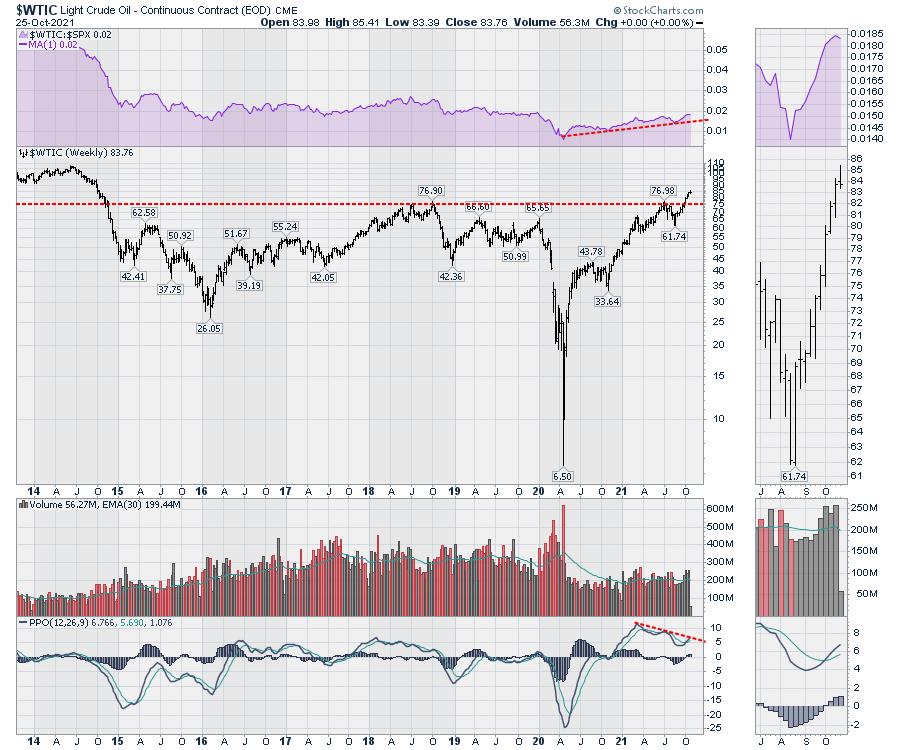

After oil accelerated from near zero last year, it reached $85 for the first time in 7 years. A few things are really interesting on the chart. I would have expected the purple relative strength to have a lot steeper slope. The second interesting point is that the PPO showing momentum is currently making lower highs but is at the trend line now.

It has been an exceptional run. The real question for everyone now is can new money go in here. While all of the inventory tightness are still in play, perhaps we can add more there. It seems a tough trade.

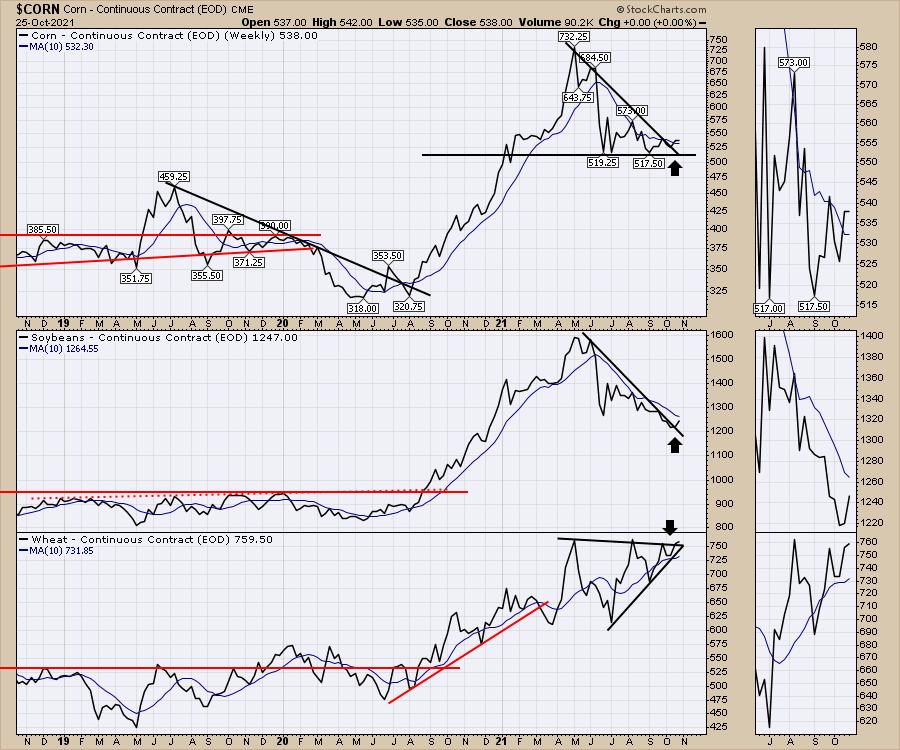

Other commodity areas that are starting to improve include Corn, Soybean and Wheat.

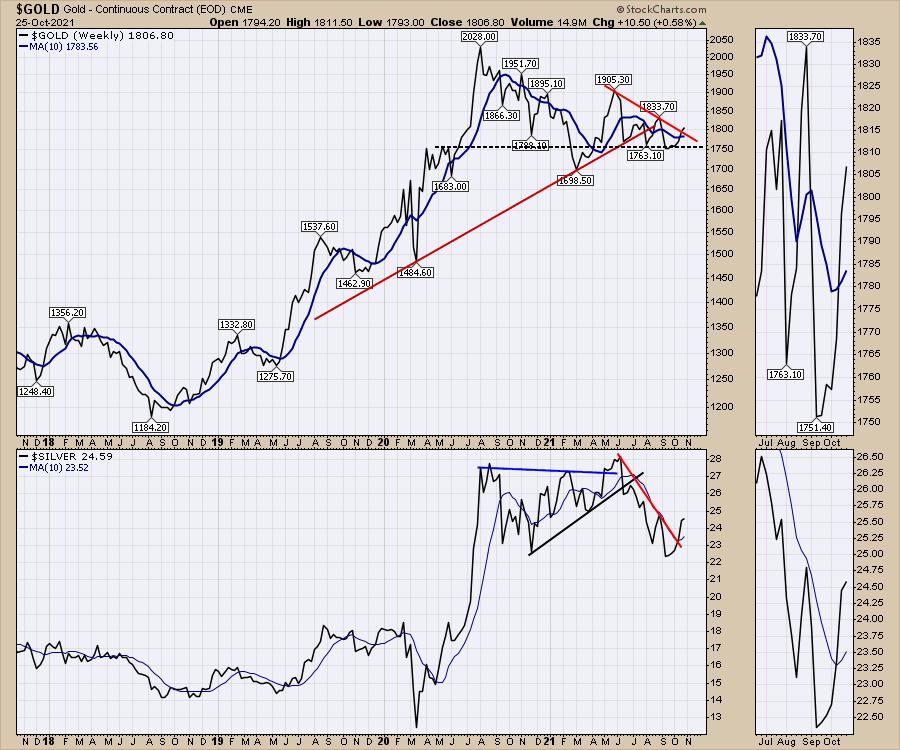

I also like the precious metals here. Both of these charts are breaking their weekly downtrends.

As nice as crude oil looks, these five other commodity charts also look like they have some significant upside. I like the idea of buying into the start of the next move, rather than playing catch up with the last move.

Greg Schnell, CMT, is a Senior Technical Analyst at StockCharts.com specializing in intermarket and commodities analysis. He is also the co-author of Stock Charts For Dummies (Wiley, 2018). Based in Calgary, Greg is a board member of the Canadian Society of Technical Analysts (CSTA) and the chairman of the CSTA Calgary chapter. He is an active member of both the CMT Association and the International Federation of Technical Analysts (IFTA).

Subscribe to The Canadian Technician to be notified whenever a new post is added to this blog!

The post The Next Big Move | The Canadian Technician appeared first on d0llars.

source https://d0llars.com/the-next-big-move-the-canadian-technician/

No comments:

Post a Comment